Land Value Taxation / Contributed

Humanity is constantly searching for ways to combat what seem to be an ever-increasing number of social issues. While many groups of dedicated citizens and lawmakers have tried to tackle issues like social inequality, climate change, and the housing crisis, these problems still persist. All of which begs the question: what can we do to help solve these issues?

One of the driving factors of unsustainable development in the United States is our economically and legislatively promoted development that is based on 20th-century standards, many of which no longer align with our social and environmental goals. There are many ideas on how to promote more sustainable development and land use in future development, but most would, in some way, detrimentally impact our economy. With the highest inflation in modern history, many people are already struggling to make ends meet. Implementing these would only serve to further exacerbate many people’s tenuous economic situation.

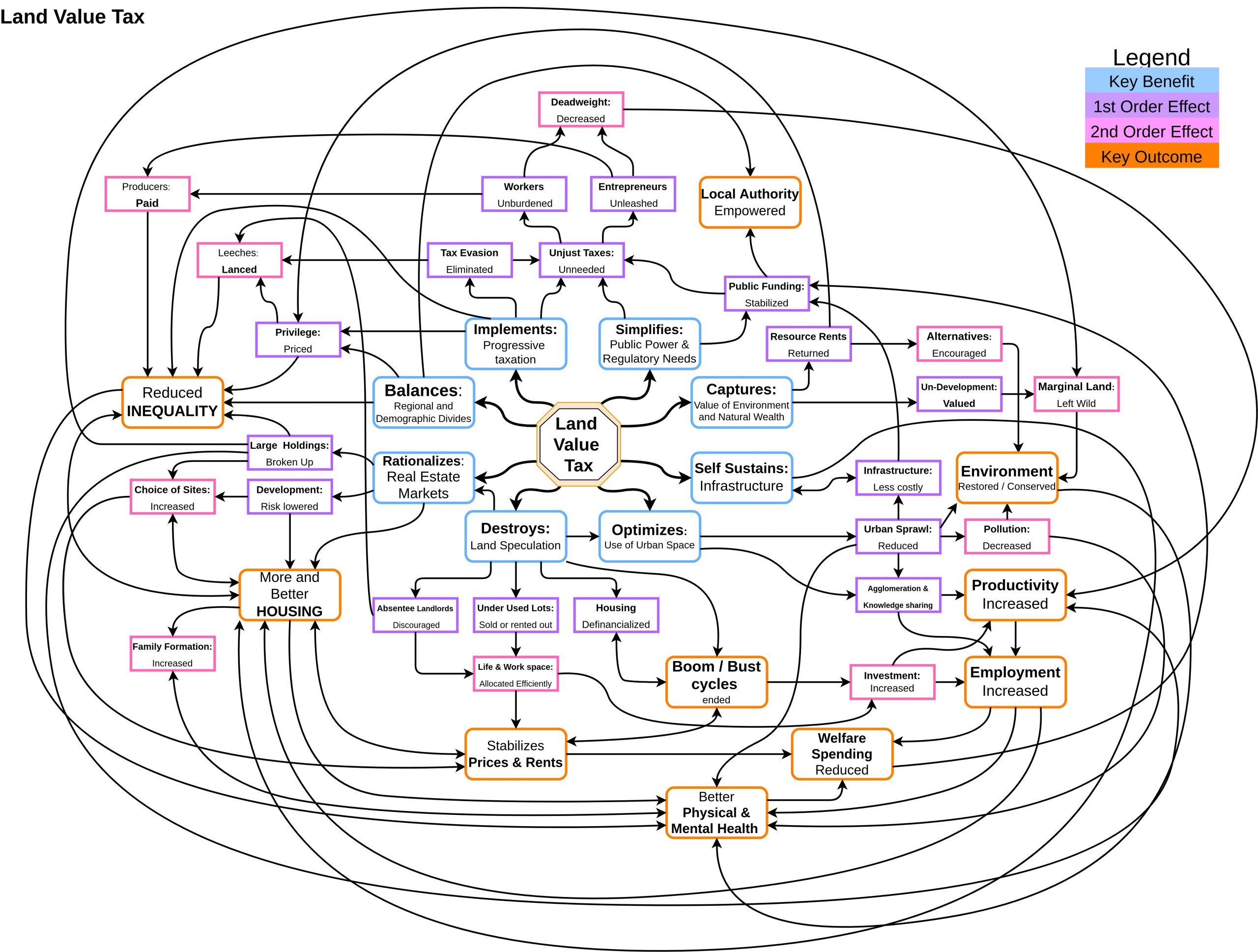

However, there is a solution that has minimal impact on business, and it’s called Land Value Taxation. Land Value Taxation, or LVT for short, is a system in which taxes are levied solely against the rental value of land in someone’s ownership. This seemingly simple change completely reprioritizes the types of urban development that can proliferate while still being economically viable.

Because taxes would be based on land, it means that almost all types of unproductive land will be losing money for its owner. This all but does away with land speculation and the hoarding of large amounts of land that serves no productive purpose to our society. All this land can be put to use creating more jobs and generating more tax revenue for the government. It also promotes higher density housing in urban settings, which can pave the way for more walkable, bikeable, transit-oriented development, all of which can serve to greatly reduce our carbon emissions on an individual level. Both effects also create more housing, especially in more urbanized areas, helping to alleviate the housing crisis. With the increase in housing, the average price of rent will go down, helping many economically disenfranchised people to find more permanent housing.

As some of the more economically astute readers may have realized, this means that renters would have to pay no taxes while landowners would be fully responsible for all tax generation. While this may be technically true, the principles of a free-market economy dictate that a roughly equal portion of these taxes will be passed through rent and through shopping at businesses to the renters. I could go on about how it promotes healthier activities, improves mental health, and completely solves tax evasion, but to fully explain all of the implications of LVT would take more space than I have in this already greatly simplified article. If you find yourself interested in learning more, I would highly recommend reading more about this fascinating subject.